How Rent to Own Works: A Guide

Are you looking to become a homeowner within the next few years? Maybe you’ve looked into buying homes but can’t afford the upfront costs. Are you a student that wants to get a head start on the post-grad home buying process? Or perhaps you aren’t able to qualify for a loan due to a weak credit score.

If any of those sounds like you, rent to own may be a good solution for you. Our guide will walk you through rent to own, a process that is fairly common, but rather confusing for a lot of people. After reading our guide, you’ll have a clear idea of how rent to own works, if it’s favorable for you, and how to start!

A Guide to Rent to Own Homes:

Table of Contents

How Rent to Own Works

The Contract Basics

Pros & Cons of Rent to Own

Should You Rent to Own?

Alternative Options

Getting Started with Rent to Own

How to Mitigate Risk

So What Now?

Helpful Links & Resources

How Rent to Own Works

Rent to own, also know as lease to own or lease-option, is an alternative to traditional renting or buying. You could even think of it as a fusion of both, since rent to own is basically just leasing a home until you become eligible to buy it.

How Does Rent to Own Work on a House?

Rent to own on a house works when a tenant leases a house from a landlord and buys it before the end of the lease. The landlord and the tenant come to an agreement when they sign the contract that the tenant can purchase the property for a set price.

First, you’ll pay a small, upfront option fee. Then, during the leasing term, you can choose to benefit by receiving rent credits that you can apply to future home expenses.

For many buyers, this option is more financially sensible than purchasing a home at full price. Rent to own enables you to move into a house right away, even if you can’t afford a down payment or qualify a mortgage.

Rent to own works because there are incentives for both the buyer and seller to make it work. After investing in the option fee, and, in some cases, premium payments, the buyer wants to get that money back. The only way for the buyer to get that money back is to actually buy the property.

The seller wants to sell his or her home and by signing the contract, the seller must sell the home if the buyer chooses to buy at some point during the lease. The seller cannot sell to anyone other than the buyer until the lease has expired. However, there is no guarantee for the seller that his or her home will be sold within the lease term because the buyer has the option to buy, not a mandate to do so. The seller trusts that the rent to own deal will work because the buyer wants the money invested back.

If the deal does not work, the seller received compensation for his or her time in the form of rent payments. However, the seller's goal was not to rent the home; he or she wanted to sell it. Therefore, if the buyer does not buy, the seller receives additional compensation – the buyer forfeits the option payment and any rent credits accumulated.

Rent to own on a home is similar to renting to own furniture or televisions. The owner is loaning you the property until you can pay the purchase price for it.

What is a Rent to Own Home?

A rent to own home is a home that an owner is looking to sell. The owner might not be able to sell the home yet because of a variety of reasons, like probate for example. Or the owner might be legally able to sell the home, but the market is slow. Rather than let the property sit empty and potentially attract squatters, a seller in these example scenarios might want to rent to own their home. Meaning they would have someone rent the house with the intention of buying it in the future. That way, the seller would be earning money on the home until the market improves or probate clears.

How Do You Rent to Own a Home?

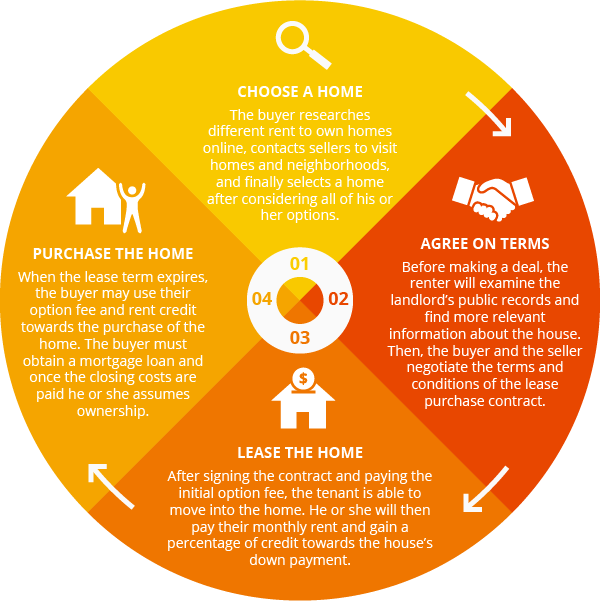

The rent to own process is pretty straightforward when broken down into four simple steps. We’ll go into more details about how complications can arise later on in the guide.

You rent to own a home by finding a home that is available to rent to own, paying a one-time option fee (usually 5 percent of the cost of the home), renting the home like you would in any other lease situation and then buying the home when you are ready. Once you decide to purchase the home, the seller credits you the option payment. Should you decide not to purchase the home, the seller keeps the option fee.

Of course, there are more details to it than that, but those depend on the specifics of your contract.

The Contract Basics

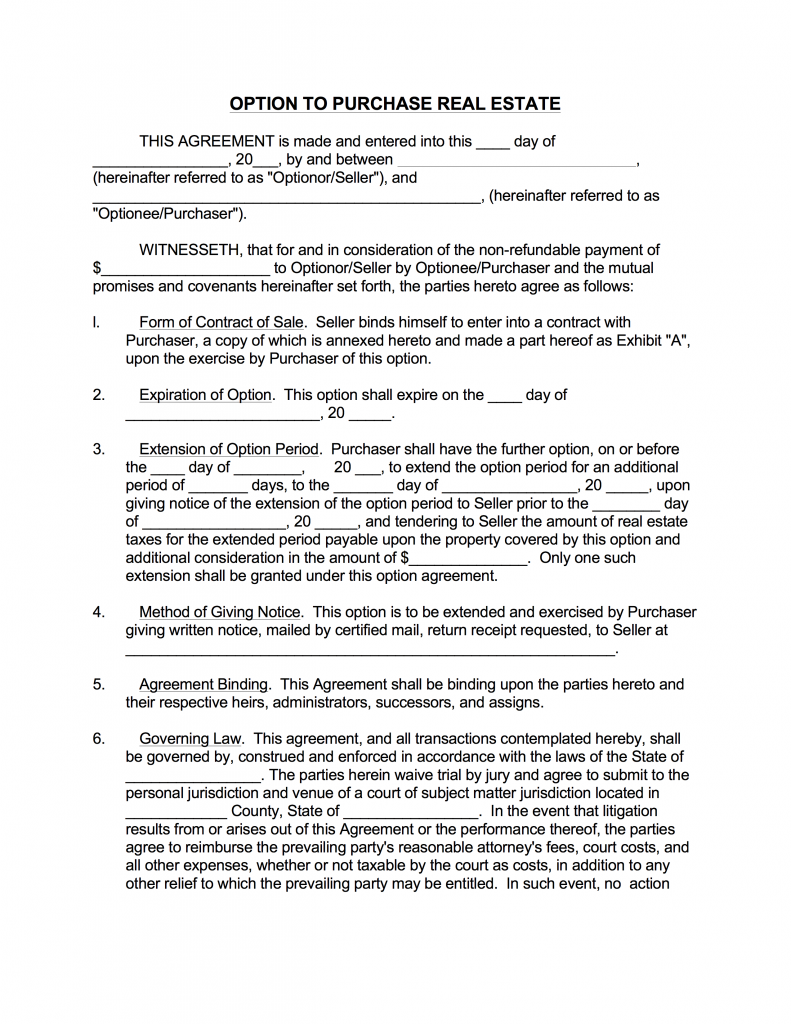

In every rental agreement, there are certain contract requirements you’ll need to follow. The same is true for rent to own agreements. In this section of the rent to own guide, we’ll discuss the option to purchase contract basics as well as some key components you should keep in mind when choosing to rent to own.

No two contracts are exactly the same, but most share similarities in their fundamental ingredients. Here are the basic elements every option to purchase contract should include:

- Purchase Price

- Standard Rent

- Closing Timeframe

- Maintenance and Other Fees

- Option Fee

- Rent Premium

- Buying the Home

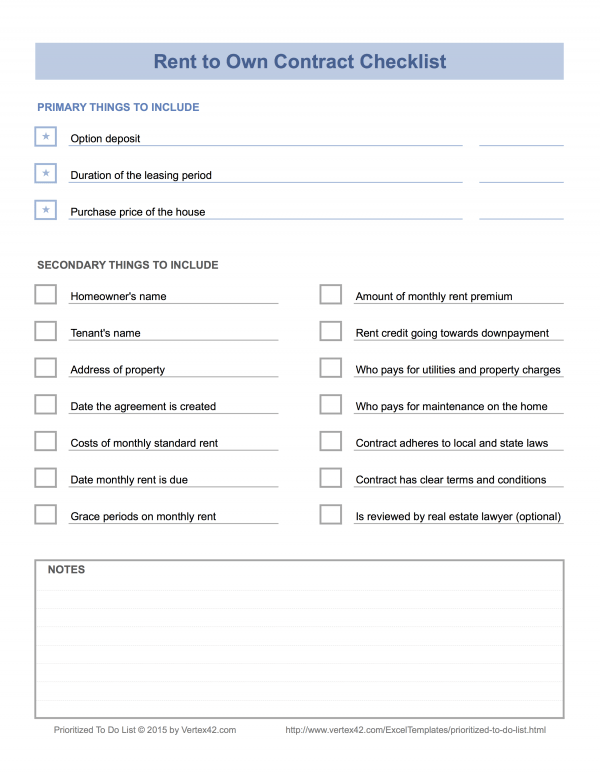

For your convenience, we have created a Rent to Own Contract Checklist and a sample Rent to Own Contract to make sure you have everything you need. Simply click the images to download them each as a PDF.

In addition to reading this guide, you may want to hire an attorney to help you review the contract since the terms can be difficult to comprehend. Legal counseling can make your process run much smoother. A lawyer can ensure that you understand all of the rent to own conditions and minimize your risks of entering into a fraud agreement with a scammer.

1. Purchase Price

At the beginning of the lease-option contract, you and the landlord will agree on a fixed price for the home. This price should be an estimate of the future fair market value of the home when the lease expires. You can check the current fair market value by using a home value estimator, which you can find on many of the major bank websites. However, to estimate the future fair market value, you should consult a local mortgage banker for more accurate, expert advice.

Remember, the home price is locked in at the beginning of the lease and remains the same until it expires, regardless of whether home values change in the future.

2. Standard Rent

Just like in any rental agreement, you’ll pay a set amount of rent per month for the duration of your lease. It’s highly recommended to check if your base rent aligns with fair market value. You can do this by either contacting a local mortgage banker or using the online Rentometer tool. You don't want to end up paying more than you should be for the home. Anything you pay that is above fair market value should serve as a rent credit.

You cannot continue to rent to own a property if it is foreclosed. So, make sure that what you pay the seller is enough to cover the mortgage, taxes and insurance for the property.

3. Closing Timeframe

You’ll have to negotiate with the seller how long your lease will last; the rental term should be exactly how long you think it’ll take you to save up for the down payment, so be very cautious here. Furthermore, you should also confirm with the seller/landlord the dates of payment for the lease, the home’s actual mortgage, and other expenses that may arise. This will ensure everything is getting paid on time and prevent issues between you and the landlord in the future.

4. Maintenance and Other Fees

It’s important to clarify who will cover the home’s maintenance charges, utilities, and property fees. Buyers who rent to own are typically cover all maintenance, repairs, and utilities on the house, unlike traditional renting.

On the other hand, the landlord usually pays property taxes and insurance, because they are ultimately responsible for their home. You should also discuss matters such as renter insurance policies and home modifications during the contract drafting. Establishing awareness of these terms and conditions will help you to prevent issues later during the leasing period.

For your reference, we’ve posted a link at the end of this guide to a list of rental property maintenance expenses.

5. Option Fee

An option fee guarantees you the exclusive option to purchase the home in the future. Typically, the option fee is non-refundable and ranges from 2 percent to 10 percent of the purchase price. If at any point during the rental term you become qualified for a mortgage, you may purchase the home and apply your option fee and rent credits towards your down payment.

Note: The option fee IS NOT OPTIONAL. In order to exercise an option to purchase contract and even be given the chance to purchase the home, you absolutely must pay the fee.

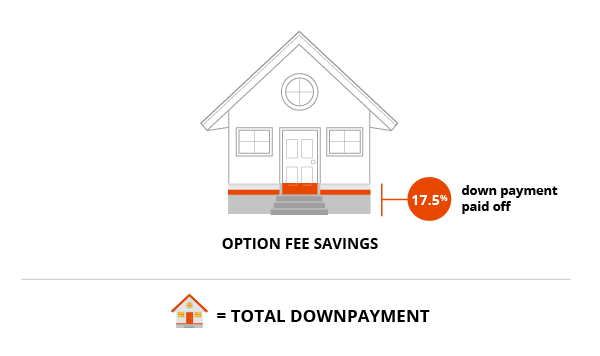

Here’s an example that hopefully will put things into perspective:

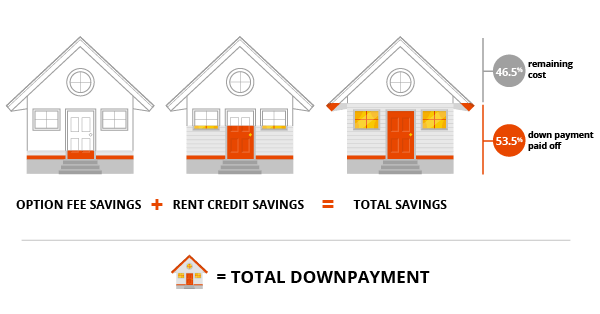

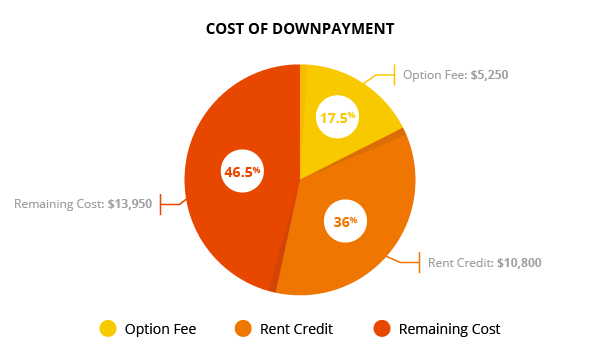

The home Tom wishes to rent to own has a purchase price of $150,000. A down payment for a conventional mortgage is $30,000 (20 percent of the purchase price). At the beginning of his lease, Tom needs to pay an option fee of $5,250 (3.5 percent of the purchase price). When he buys the home, Tom's $5,250 option fee is credited to the $30,000 down payment. Thus, he has already saved 17.5 percent of his down payment (see below).

6. Rent Premium

In addition to standard rent, you may pay a rent premium. Rent premiums are a percentage of your monthly rent cost that are applied toward your purchase. Rent premiums are also known as rent credits because they're a portion of your rent that is credited back to you if you purchase the home. The percent is negotiable, but usually, ranges from 15 percent to 25 percent of the rent price. So you’ll be paying more per month for rent than you normally would, but that’s only because you’re receiving credit towards the home purchase.

If you decide to purchase the home, the total rent premium you have paid will be subtracted from the cost of the down payment. Only the rent premium, not the standard rent, goes towards equity in the home.

The rent credits have been stored in an escrow account by the seller, which is separate from the seller's bank account. The money is given to the bank as part of your down payment along with your option fee when you buy.

However, if you cannot or do not wish to purchase the home, the seller gets to keep all the rent premium you have paid throughout the leasing term.

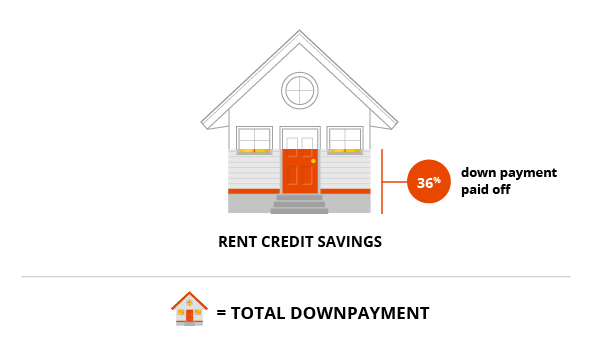

Using the same example as above, let's look at how the rent premium works:

Let’s say Tom agrees to pay standard rent of $1,500 per month to his homeowner. Tom pays an additional $300 per month, which is 20 percent of the standard rent. His total rent cost $1,800 per month. If Tom’s lease term is three years, he will have saved $10,800 from rent credits or 36 percent of the cost of the down payment (see below).

Rent Credit Variations

Some sellers actually charge you fair market value for the rent and credit a part of that to you if you purchase the home. It's important to note that is a very good deal for the buyer, but it's uncommon. In this scenario, Tom would save the same amount of money as the above, but instead of paying $1,800 per month, he would pay $1,500 per month.

A more common variation is for the seller to match the buyer's premium payments. Let's continue from the example above and look at how rent credit matching works:

The seller of the property Tom is renting to own has agreed to match Tom's $300 premium payment. So, instead of saving $300 per month, Tom is saving $600 per month. Over the course of 3 years, Tom saved $21,600 or 72 percent of the cost of the down payment.

7. Buying the Home

Now, you know how standard rent, rent credits, and option fees work. But what happens once your lease ends? Let’s add up our total savings at the end of the lease period:

Since Tom’s option fee was $5,250 and his accumulated rent credit was $10,800, by the time his lease expires he has saved up $16,050, approximately 53.5 percent of the down payment (see below).

If at the end of the term you can’t afford to purchase the house or decide you’d rather not buy it, the non-refundable option fee and rent credit would expire. You’d lose all equity earned towards the home, and the seller would keep your option money and rent credit.

It’s important to treat a lease option as a commitment to buy the home. Consider all the pros and cons to protect yourself from these risks. In the next section, we will discuss some of these factors.

Pros & Cons of Rent to Own

Renting to own has many benefits that can save you a lot of money in the long run. However, if you’re not careful, a lease option could damage your finances for many years. Learn the pros and cons of rent to own to ensure you make a wise real estate decision.

Pro #1: Build Equity and Improve Your Credit

Your rent premium applies towards your down payment, and the premium equals about 15-25 percent of your standard rent. This may not seem like a lot, but in a few years you could accrue several thousand dollars, compared to traditional renting.

Your rent premium applies towards your down payment, and the premium equals about 15-25 percent of your standard rent. This may not seem like a lot, but in a few years you could accrue several thousand dollars, compared to traditional renting.

The lease option is ideal for those who need to repair their credit history, since you don’t need good credit to qualify for a rent to own contract. This option can give you the opportunity to increase your credit score by keeping your balances low, paying your bills and eliminating debt.

The lease option is ideal for those who need to repair their credit history, since you don’t need good credit to qualify for a rent to own contract. This option can give you the opportunity to increase your credit score by keeping your balances low, paying your bills and eliminating debt.

Pro #2: Agree on a Fixed Price

Having a set price for the home eliminates the uncertainty of changing market prices. So, you have something to budget for. Furthermore, having a fixed price creates an incentive to organize their personal finances and spending habits; you might even be able to purchase your home before the lease expires.

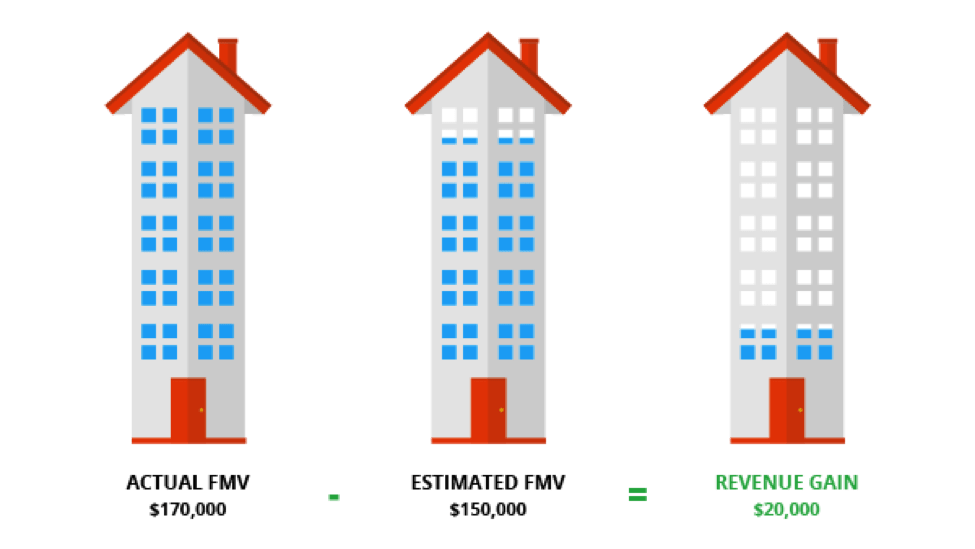

Another benefit of fixed prices is the potential for you to gain money if the set price is lower than the actual fair market value of the home when the lease expires. To understand this concept, let's look at an example:

Say Tom and his seller under-estimate the fair market value of the home to be $150,000 three years from now. If the actual FMV turns out to be $170,000, Tom would gain $20,000 (see below).

Pro #3: Gain Familiarity With Home

While leasing to own, you’ll have the advantage of learning the pros

and cons of the home. Not only will you gain familiarity with the home, but you will also become accustomed to its respective neighborhood and city. You’ll also get to know the strengths and weaknesses of the home, as well as any improvements or repairs that need to be made before taking ownership.

Con #1: Undergo Strict Regulations

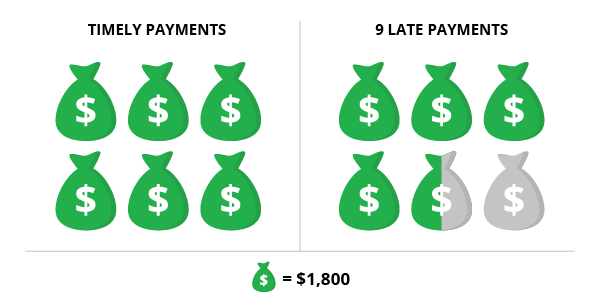

During the lease, buyers face strict regulations. Punctuality is heavily stressed. If you don’t stay up to date with rent, even if you’re just one day late, it could have serious consequences. The seller could void your rent credit for the month. Meaning, that month's premium payment wouldn't count toward the cost of the home. Let’s see how late payments affect equity when renting to own:

Tom has monthly rent credit of $300, however, during his 36-month rent period, he made nine late payments. As a result, Tom would lose $2,700 total towards the cost of the house (see below).

Con #2: Unforeseeable Risks

Due to the uncertainty of future circumstances, it’s inevitable that buyers will be subject to risks.

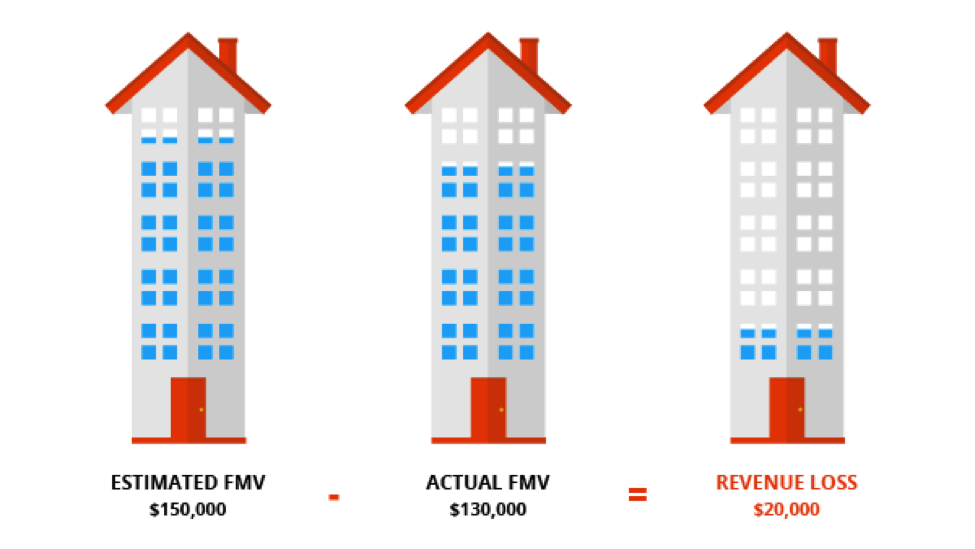

For example, you could overestimate the price of the home and end up paying more money than fair market value cost. Let’s look at how fixed prices can put you at risk of losing money:

Say Tom and his seller over-estimate the fair market value of the home to be worth $150,000 three years from now. If the actual FMV turns out to be $130,000, Tom would lose $20,000 (see below).

If you aren’t careful, the seller themselves could even put you at jeopardy. If they can’t afford to pay the mortgage, taxes or other payments on their property, the bank could place the home in foreclosure and you’d be forced to leave the premises. On the other hand, if the time comes for the contract to expire and you can’t purchase the home, it could result in a lot of acquired debt on your end.

If you aren’t careful, the seller themselves could even put you at jeopardy. If they can’t afford to pay the mortgage, taxes or other payments on their property, the bank could place the home in foreclosure and you’d be forced to leave the premises. On the other hand, if the time comes for the contract to expire and you can’t purchase the home, it could result in a lot of acquired debt on your end.

Should You Rent to Own?

As we discussed in earlier sections of the guide, there are many rent to own benefits. However, depending on an individual’s financial situation, it may not be worth it in the long run. Take our quiz below to evaluate if rent to own is really for you:

Alternative Options

So perhaps after reading thus far in the guide, you’ve decided that Rent to Own just isn’t for you. Maybe your credit score is too low and you’re drowning in a sea of debt. Or maybe your savings are pretty high and you already have enough for a down payment or a mortgage.

Regardless, there are definitely other options out there and one of them is bound to work perfectly for you. In this next section we’ll explore some popular rent to own alternatives.

1. Buy or Rent

Buying a home through a conventional mortgage should be your go-to move if you qualify. Hands-down, it is a better option than rent to own. You'll save money on paying rent and build a greater amount of equity in your home. Do this if you can afford to make a 20 percent down payment and if you qualify for a mortgage in terms of credit scores and job history.

2. Buy with an FHA Loan

The Federal Housing Administration’s mortgage program has been around ever since FDR installed it in the 1930’s and has been quite popular ever since. In this agreement, you can make a down payment on a home as low as 3.5 percent if you have a minimum credit score of 580 and meet other financial qualifications. It’s actually an insurance program, so you would be paying premiums in order to receive coverage for things such as potential lender losses. This is your best bet if you have enough money for a smaller down payment and you're ready to make the financial commitment to owning a home.

3. Rent

Renting a home would be a better choice if you need a few more years to repair your credit and can’t afford the upfront costs associated with renting to own. Once you've saved up enough money for an option fee, then you can start your rent to own journey to owning a home.

Getting Started with Rent to Own

You’ve read through our guide, deliberated for some time and finally decided that rent to own sounds like a good option. Getting started with the rent to own process might seem daunting because of all the responsibilities that come with it. However, with some advice and instruction, we can put you in the right direction.

Let’s review our step-by-step strategy on how to rent to own:

Step #1: Decide on a Property

Start by looking for homes on the Internet. Luckily for you, we have millions of property listings on Rent to Own Labs from locations all over the country. Once you’ve narrowed down your top choices, contact the sellers and ask to see the homes. Meet them, get to know them and ask questions. While touring properties, inspect as much as you can. Keep your eye out for things that look damaged or broken. In addition to the home, explore the neighborhood at different times of day to determine if this is somewhere you’d like to live.

Start by looking for homes on the Internet. Luckily for you, we have millions of property listings on Rent to Own Labs from locations all over the country. Once you’ve narrowed down your top choices, contact the sellers and ask to see the homes. Meet them, get to know them and ask questions. While touring properties, inspect as much as you can. Keep your eye out for things that look damaged or broken. In addition to the home, explore the neighborhood at different times of day to determine if this is somewhere you’d like to live.

Step #2: Seek Advice From Expert Sources

After you pick a home, it’s pivotal that you conduct further background research. Consult a highly experienced mortgage loaner who can advise you on credit repair planning. A score of 580 is usually the minimum you must have to qualify for a loan, but some lenders only accept scores above 620. The higher your score, the easier it will be to receive financing for the home.

After you pick a home, it’s pivotal that you conduct further background research. Consult a highly experienced mortgage loaner who can advise you on credit repair planning. A score of 580 is usually the minimum you must have to qualify for a loan, but some lenders only accept scores above 620. The higher your score, the easier it will be to receive financing for the home.

In addition, you should strive to educate yourself about the house’s history and confirm the seller’s credibility by investigating their former transactions.

Step #3: Establish the Option to Purchase Contract

After speaking to professionals, you should have a pretty general idea of your responsibilities as a tenant using an option to purchase contract. The last step you must make before moving into the house is to meet with your seller to develop the lease-option arrangement.

After speaking to professionals, you should have a pretty general idea of your responsibilities as a tenant using an option to purchase contract. The last step you must make before moving into the house is to meet with your seller to develop the lease-option arrangement.

While in the process of developing the contract, you may want to call a real estate lawyer several times to guarantee a full understanding of the different clauses within the agreement. Your lawyer can also assess the seller’s propositions and verify if they are trustworthy to ensure you won’t fall victim to legal scams.

Step #4: Move Into the Home

You’ve signed the option to purchase contract and now you finally get to move into the home. However, your work doesn’t stop there.

You’ve signed the option to purchase contract and now you finally get to move into the home. However, your work doesn’t stop there.

You’ll only get to reap the benefits of rent to own if you work hard to build your financial profile during the lease term. In order to improve your profile within that span of time, you must raise your credit score, consistently generate income, and save up for the down payment.

How to Mitigate Risk

When entering into any kind of legal contract, it’s important to be aware of the risks you may face in doing so. A buyer will often make the mistake of agreeing to rent to own without thorough consideration beforehand.

As a result, the buyer may be subject to the effects of his or her carelessness. In this section, we will show you how to diminish these risks so that it doesn’t happen to you.

1. Do Your Research

It’s crucial that you try to learn as much as you can about the home. Not having enough information is the biggest mistake you can make when entering an option to purchase contract. First, you should attempt to get ahold of the seller’s public records to find out if they’ve engaged in illegal activity in the past. Then, you should try to retrieve any available information about the property to make sure nothing suspicious or out of the ordinary has occurred. Lastly, you should evaluate your pros and cons.

2. Build Your Credit

One of the main reasons why buyers choose to rent to own over conventional renting is to improve their credit for the duration of the lease. Before purchasing a home you should always be realistic about your personal finances; if you are unable to obtain a mortgage loan when your lease term expires, you could lose your option fee and all of your equity towards the home. Therefore, it’s probably a smart idea to consult professionals before undergoing the rent to own process.

3. Actually Commit to the Home

As soon as you sign the option to purchase contract, you pretty much agree that you’ll buy the home. At least, it makes the most sense that you would. You paid the initial option fee and a rent premium to have the ability to purchase the house.

Think about it. If you decide after the lease expires that you truly don’t want to purchase the home, that’s thousands of dollars you’ll waste, and who wants that? Before entering into a rent to own agreement, you should always be serious about buying the home and not be on the fence about it.

4. Create a Backup Plan

So perhaps you followed all the steps in our guide about mitigating risk, but something still went wrong in the rent to own process. We must realize that in life many things are out of our control. However, it never hurts to have a backup plan to resolve problems as smoothly as possible.

For those worried about the seller managing your equity, you can secure legal protection of your payments with an escrow. An escrow account is a third-party account that holds and protects your money until your lease expires or you close. This will keep your rent credit and option fee out of the seller’s reach until a specific point in time.

So What Now?

To sum it all up, renting to own should be treated just as seriously as any other purchasing option. If your goal is to eventually own a home, this kind of decision shouldn’t be taken lightly.

Rent to own buyers are susceptible to risks and scams. It’s necessary to research and weigh the pros and cons before entering into the option to purchase contract.

I bet you’re wondering, what now? Are you ready to start looking for rent to own home listings? Or would you rather learn more about other related topics? Either way, we’ve provided multiple helpful links and sources down below to get you started.

Helpful Links & References

Related Articles:

- Mortgages – A Beginner's Guide

- How to Save for Your First Down Payment

- Here’s A Simple Guide To Improving Your Credit Score

- 6 Traps That Snare First-Time Renters

- List of Maintenance Expenses on Rental Property

- Field Guide to Buying Vs. Renting

- The Definitive Guide to Using Seller Financing to Buy Real Estate

- What Is a Wrap-Around Mortgage?

- FHA Loan – The Complete Consumer Guide

Sources:

About the Rent to Own Home Option | creditreport.com™. (2014, May 8). Retrieved December 20, 2015, from https://www.creditreport.com/blog/how-to-rent-a-house-with-the-option-to-buy/

Folger, J. (2014, October 7). Rent-To-Own Homes: How The Process Works. Retrieved December 20, 2015, from http://www.investopedia.com/articles/personal-finance/100714/renttoown-homes-how-process-works.asp

How Does Renting-To-Own Work? | Zillow. (2015, August 5). Retrieved December 20, 2015, from http://www.zillow.com/mortgage-learning/rent-to-own/

Latham, S. (2015, October 23). Rent-to-Own Homes, Explained – The Simple Dollar. Retrieved December 20, 2015, from http://www.thesimpledollar.com/rent-to-own-homes/

Real Estate Advice – Expert Answers on Zillow. (n.d.). Retrieved January 6, 2016, from http://www.zillow.com/advice/US/all/question-discussion-guide/rent-to-own/

Richardson, V. (2010, March 30). Rent to Own Homes – Pros/Cons, Tips, and More | Bankrate.com. Retrieved December 20, 2015, from http://www.bankrate.com/finance/mortgages/rent-to-own-when-it-s-not-time-to-buy-1.aspx

Siddons, S., & Opfer, C. (2008, July 16). How Rent-to-own Works. Retrieved December 20, 2015, from http://home.howstuffworks.com/real-estate/buying-home/rent-to-own-homes.htm

Tuman, D. (2012, October 12). Rent To Own Explained | Zillow. Retrieved December 20, 2015, from http://www.zillow.com/wikipages/Rent-To-Own-Explained/

What You Should Know About Land Contracts. (2011, June 18). Retrieved December 20, 2015, from http://www.ohiolegalservices.org/public/legal_problem/consumer-rights/home-ownership/what-you-should-know-about-land-contracts/landconth5.pdf

Woolsey, M. (2009, March 2). Rent-To-Buy Pros And Cons. Retrieved December 20, 2015, from http://www.forbes.com/2009/03/02/renting-mortgage-property-lifestyle-real-estate_rent_to_buy.html